***What’s New***

FSA

- 2025-26 plan year will begin on July 26, 2025, and will go through July 24, 2026

- 2024-25 plan year began on July 27, 2024, and will go through July 25, 2025

- The maximum employee contribution is $3,300 for the 2025-26 plan year

- The maximum amount eligible to be rolled over to the 2025-26 plan year has increased to $660

DCAP

- 2025 DCAP plan year began on January 1, 2025 and will end on December 31, 2025

San Bernardino County offers two flexible spending accounts (Health and Dependent Care) that provide tax-savings. FSAs allow employees to take a pre-tax deduction from their income to pay for eligible health and/or dependent care expenses. Employees are eligible to participate in the FSAs if they are covered under a Memorandum of Understanding, Compensation Plan, or Employment Contract.

Enrollment

Employees are eligible to enroll into the FSA and/or DCAP during:

- Open enrollment

- If the employee experiences a mid-year change-in-status event

Plan Year Periods

| FSA | DCAP |

|---|---|

| July 26, 2025 – July 24, 2026 | January 1, 2025 – December 31, 2025 |

Contributions & Roll Over

Below is the IRS maximum contribution amount for the FSAs and the County’s eligible roll.

- The maximum employee contribution is $3,300 for the 2025-26 plan year

- The maximum amount eligible to be rolled over to the 2025-26 plan year has increased to $660

How the Plans Work

Eligible employees elect an annual contribution amount to be placed in their FSA and/or DCAP account. The annual contribution is made via bi-weekly payroll deductions in equal installments throughout the year. Participants can access their FSA and/or DCAP contributions through the following ways:

- Using their FSA benefit card.

- Submitting a claim for approval (see “How to File a Claim” section)

Eligible Expenses:

Eligible health care expenses include:

- Coinsurance, Copays and Deductions

- Medical and Prescriptions

- Dental and Orthodontia

- Eye Exams, Eyeglasses and Lasik Eye Surgery

Eligible dependent care expenses include:

- Licensed nursery schools, qualified childcare centers, after school programs, summer camps, preschool

- Adult daycare facilities

How to file a claim

Step 1

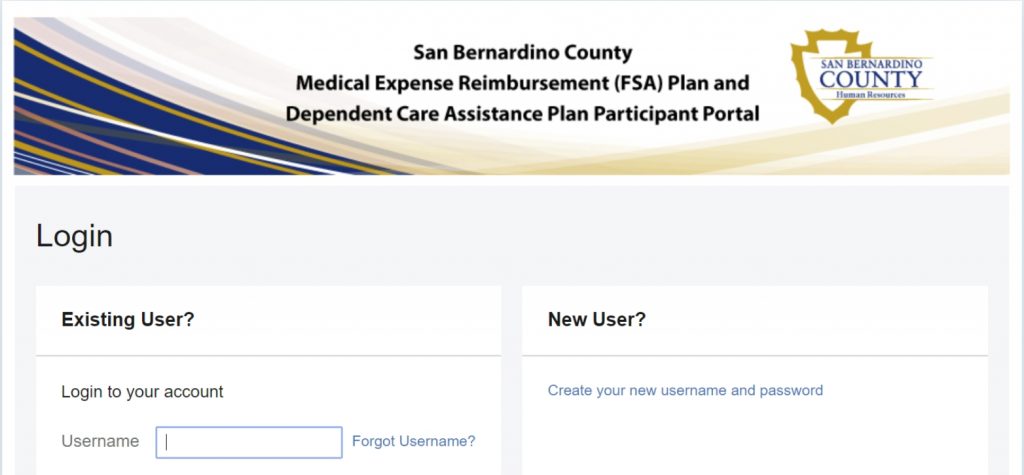

Log into your FSA/DCAP Participant Portal.

Electronic: Submit claim and upload supporting documentation (e.g. receipts) online via the FSA/DCAP Participant Portal.

Step 2

Determine which kind of claim you will be submitting, FSA or DCAP, then create a reimbursement claim on the FSA/DCAP Participant Portal.

FSA

Note: If claiming mileage, a print out of an online map source (i.e. google maps) that includes the starting and ending destination points and total miles traveled will need to be provided.

The form has to have the following information for claims:

- Date of services/ products incurred

- Name of the person who the expense was incurred for

- Dollar amount being claimed

- Provider name

- Expense category

DCAP

Note: If claiming mileage, a print out of an online map source (i.e. google maps) that includes the starting and ending destination points and total miles traveled will need to be provided.

The form has to have the following information for claims:

- Name, date of birth, and relation of dependent

- Name, address, and taxpayer ID or social security number of dependent care provider

- Date(s) of services

- Amount claimed for reimbursement of dependent care expenses incurred

Step 3

Attach all supporting documentation from the provider, vendor or merchant (i.e. receipt, statement, or bill) that includes all of the following:

- Description of service or product rendered

- Payment received for expense

- Amount paid to other part (i.e insurance) for expense

Step 4

Submit your claim directly through the FSA/DCAP Participant Portal.

Note: Claims for eligible expenses incurred within the plan year can be submitted for reimbursement no later than ninety (90) days after the end of the plan year.