Submit your completed enrollment form to hrfsadcap@hr.sbcounty.gov.

Dependent Care Assistance Plan (DCAP)

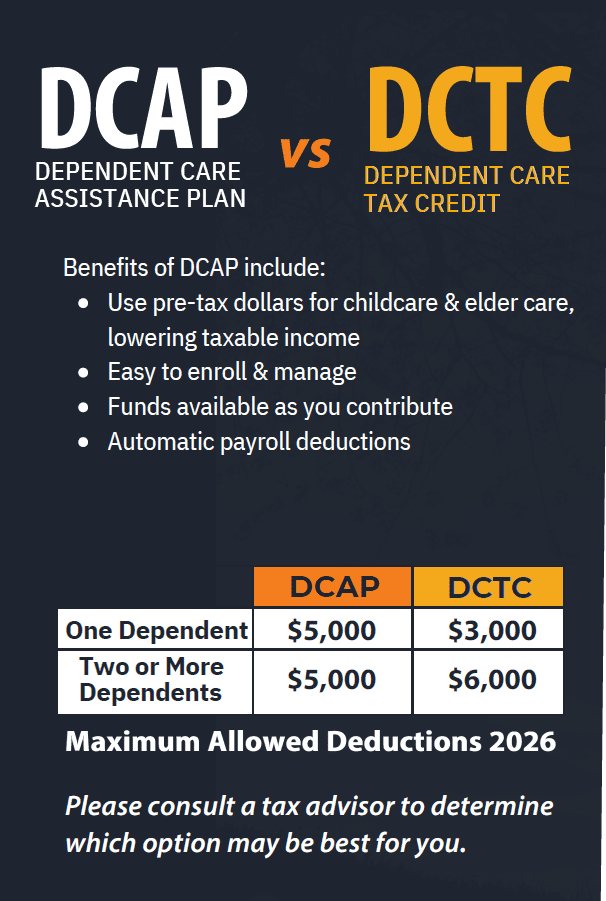

San Bernardino County offers a Dependent Care Assistance Plan (DCAP) that allows you to take a pre-tax deduction from your income to pay for eligible dependent care expenses as an alternative to taking the Dependent Care Tax Credit (DCTC).

What’s New

The 2026 DCAP plan year Open Enrollment begins November 1, 2025 and will end November 28, 2025.

The 2026 DCAP plan year will begin January 1, 2026, and will end December 31, 2026.

The 2025 DCAP Plan year began January 1, 2025, and ends December 31, 2025.

Below are key considerations for DCAP participants.

Annual Limits: San Bernardino County’s annual contribution limit for the 2026 DCAP will remain at $5,000 annually.

Roll Over: The IRS does not allow for DCAP funds to be rolled over in to the following plan year.

Eligible employees make an election to authorize a bi-weekly deduction amount from their pay to be placed into their DCAP account. When an eligible expense is incurred, a DCAP Reimbursement Request form must be submitted, along with proof of payment and a statement of service that supports that the expense was incurred. The expense must be incurred during the plan year to be eligible.

Employees are charged a nominal fee of .70 cents per pay period to cover administrative costs.

Employees are eligible to participate in the DCAP if they are covered under a Memorandum of Understanding, Compensation Plan, Employment Contract or Contract with an entity that expressly provides eligibility for the DCAP.

Per IRS regulations, your election is irrevocable. You may not revoke or change your election for the remainder of the Plan Year unless you experience a Section 125 qualifying Mid-Year Change-in-Status Event.

Employees may enroll in the DCAP:

- During the annual DCAP open enrollment period in November each year

- Within sixty (60) days of a Section 125 Qualifying Change-in-Status Event. The requested DCAP election change must be consistent with the event. This may include but is not limited to the following:

- Commencement of County employment (New Hire)

- Marriage

- Divorce or legal separation

- Death of spouse or dependent

- Birth or adoption of a child or placement for adoption/guardianship

- Termination of spouse’s employment

- Commencement of spouse’s employment

DCAP plan elections are only valid for the current plan year. Employees must elect to enroll in the plan each year to continue participation. The DCAP plan year effective date is January 1, each year.

A qualified dependent under the DCAP is a dependent that an employee can claim for federal tax purposes and is:

- Employee’s child who was under age 13 when care was provided and lived with the employee for more than half of the calendar year.

- The child must be the employee’s son, daughter, stepchild, sibling, step-sibling, or a descendant of any such individual, eligible foster child, legally adopted child, or a child lawfully placed with the employee for adoption.

- The child must not have provided over one half of their own support during the calendar year.

- Employee’s spouse, relative or child over the age of 13, who is physically or mentally incapable of self-care, lived with the employee for more than half of the calendar year, and regularly spends at least eight (8) hours each day in the employee’s household.

- Dependents defined by Internal Revenue Code Section 152 as a qualifying relative must meet the following criteria to be eligible:

- Received more than half of his or her support from the employee for the calendar year.

Claims for eligible expenses incurred within the plan year can be submitted for reimbursement no later than ninety (90) days after the end of the plan year.

The maximum annual contribution for the calendar year is the lowest of the following amounts:

- $5,000 for single persons or married couples filing jointly

- $2,500 for married persons filing separate federal tax returns

- The earned income of the employee or employee’s spouse

When deciding on an annual contribution amount, keep in mind that:

- Elections for the plan year are irrevocable unless you experience a midyear qualifying change-in-status event

- DCAP contribution amounts that are not claimed for reimbursement do not rollover to the next plan year. Any unclaimed funds will be forfeited and applied toward the cost of administering the plan

- If your spouse also participates in a DCAP, the annual maximum includes any benefits he or she received under the DCAP

- Expenses reimbursed through your DCAP account may not be applied to your dependent care tax credit

Pursuant to IRC Section 129, expenses are considered eligible for reimbursement if the expense:

- Enables the gainful employment of you or your spouse

- Is paid on behalf of a qualified dependent

- Is incurred for dependent care that is provided by an eligible dependent care provider

Expenses that are not eligible for reimbursement under the DCAP include expenses paid for dependent care which do not enable you or your spouse to work; expenses paid to a person who you or your spouse are entitled to claim as an exemption for federal income tax purposes; tuition or education expenses for a child in kindergarten or above; fees paid to your child who is age 18 or younger for babysitting; overnight care at a convalescent nursing home for a dependent relative; overnight camp; or expenses for lessons, tutoring or transportation.

Eligible dependent care providers include the following:

- A licensed daycare center (must care for more than six children who do not live at the daycare center)

- A private babysitter

- An elderly or handicapped care center

- In-home medical attendant care

Note: You must provide the name, address and tax identification number of your dependent care provider on all claims and on your tax return.

DCAP funds will be made available in an amount that is equivalent to or less than your available account balance. Eligible claims for reimbursement that exceed your available account balance will be paid out as funds become available each pay period until your claim has been fully reimbursed or you met your annual contribution limit.

All claims for reimbursement are subject to review and require both a DCAP Reimbursement Request Form and copies of supporting documentation in order to be processed for approval.

Employees have the option to file claims either electronically or manually.

- Electronic: Submit claim and upload supporting documentation (e.g. receipts) online via the FSA/DCAP Participant Portal.

- Manual: Submit paper reimbursement claim form and copies of supporting documentation.

In order for the EBSD to substantiate a submitted reimbursement claim form, the following is required:

- Name, date of birth, and relation of dependent for whom the expense was incurred

- Name, address, and taxpayer ID or social security number of dependent care provider

- Date(s) of service

- Amount claimed for reimbursement of dependent care expenses incurred

Supporting documentation from the dependent care provider (e.g. receipt, statement, or bill) must include the following:

- Date(s) of service

- Description of services rendered

- Payment received for services rendered

Note: Canceled checks to dependent care providers are not sufficient as stand-alone documentation, as they do not satisfy the independent third party documentation requirements.

The methods to obtain reimbursement for eligible dependent care expenses from a DCAP account are as follows:

- Benefit Card: Employees have the ability to access DCAP account funds directly at the point of service using the Benefit Card. This will commonly be referred to as a “Benny” card. The card enables employees to obtain real time reimbursement for expenses that are able to be auto substantiated without having to file a claim form or supporting documentation. Please note: If participating in both the County’s Flexible Spending Account (FSA) and the Dependent Care Assistance Plan (DCAP), account funds will be accessible on the same Benefit Card. For more information, see FAQs.

- Direct Deposit and Checks: In accordance with the County’s Direct Deposit Policies, DCAP reimbursements will be issued via Direct Deposit. DCAP claim reimbursements will be deposited in an employee’s balance account on file with EMACS. Employees can view their designated balance account via EMACS – Self Service or the FSA/DCAP Participant Portal. In the case of unforeseen circumstances that impact an employee’s account (e.g. identity theft), participants will be able to request that funds be issued via check for the duration of one pay period.

Note: This webpage only contains a summary and partial listing of DCAP Plan benefits, terms, conditions, exclusions and limitations. For a full and complete listing, please refer to the appropriate plan document. If any differences appear between this summary and the plan document, the information in the plan document shall govern.

Contact Us

Employee Benefits Services Department

175 West Fifth Street , First Floor

San Bernardino, CA 92415-0440

Phone: 909.387.5787

Email: hrfsadcap@hr.sbcounty.gov

FSA/DCAP Participant Portal